How To Enter Commercial Bills

v1.1 09/30/04

The basic rules for succesful commmercial invoicing are:

1) Post Payments as received. When you get a check,

post it that day, as you would expect.

2) DO NOT ENTER COMMERCIAL INVOICES UNTIL AFTER YOU HAVE

RUN THE REGULAR FINANCE CHARGES FOR THE MONTH.

3) Post ALL commercial invoices before the end of the month

of

service. If an invoice has a service date of 08/01/04-08/31/04,

make

the invoice before month 9.

If you cannot, you have several choices:

If you've entered the invoice, accept that the

line will not be

detailed on the bill, but included in the balance (commercial bills are

really statements of activity for the chosen month- the amount due at

the botom of the page is ALWAYS the clients CURRENT outstanding due,

not the amount due at the end of the statement month, which might be

different if you've gotten out of synch with the billing.

Another option is to fake the date and time on

the PC runnning

the bills by changing the system clock to the last day of the statement

month and run the bills. This will detail the invoices instead of

bundling them into the prior balance, but payments made after the

statment month won't be included in the "Payments Received in Month",

but they WILL be included in the Starting balance and Please Pay this

Total- it will confuse folks a little, but the total due will reflect

their true debt and the received posted payment will have been

credited, even though it is more recent than the statement month.

The final option is to run the bills as is,

after the statement

month (you still give the statement month as the date to the billing

run), here the detail lines will not print and instead the last invoice

will be listed, it's dollars listed to the left of the the usual

column, and the month's invoices bundled into the Starting

Balance.

The bottom line is the CURRENT balance-reflecting any posted receipts

or invoices beyond the statement month.

NB: If you screw up Rule 2, finance charges will be levied

prematurely on invoices that are NOT overdue and have not yet been

billed.

IN SUMMARY

It is standard procedure to run the follow the 3

steps described

above. The office should try to make commercial invoices promptly

after running

the finance charges, and run the commercial bills in the same

month.

If you need to, move the Finance charge run up a day so you have time,

do that. You DON'T have to run the Regular Residential Bills

immediately after you run the Finance charges-the balances will be

brought up to date before any bill printing starts, so the finance

charges, late fees, monthly fee and any payments made AFTER "Generate

Finance Charges" will be summed and included in the bill's

balance.

So you can run finance charges, then key in commercial invoices, then

print the commercials and/or the residentials at ANY TIME BEFORE THE

END OF THE MONTH. If you wait past then, see rule three above.

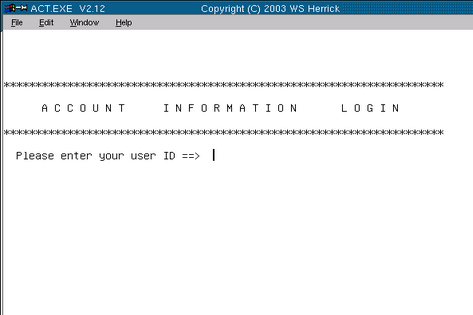

Launch the program

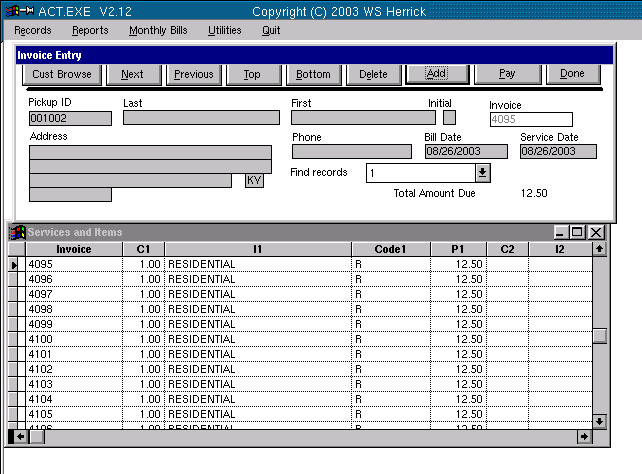

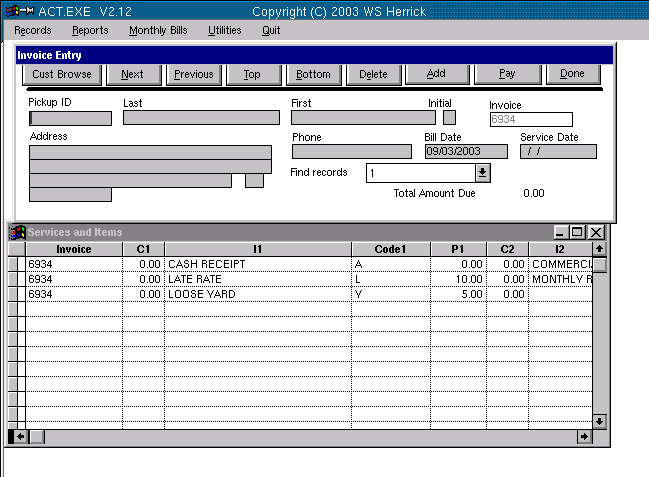

Select Records, then Bills/Credits. You will see something like

this:

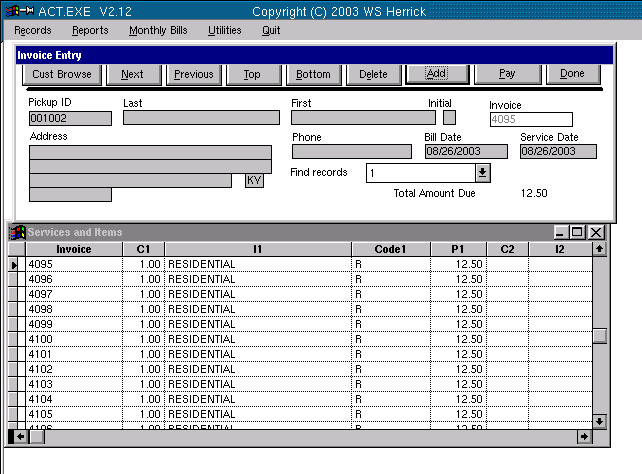

Now Click the ADD button to add an invoice

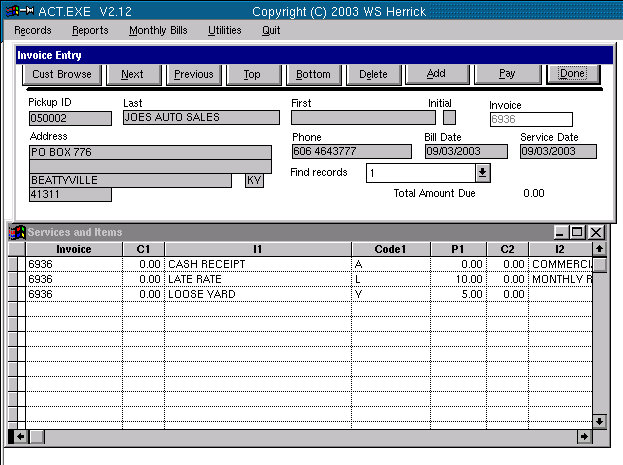

Key in the Customer ID # in the PICKUP ID field and press enter,

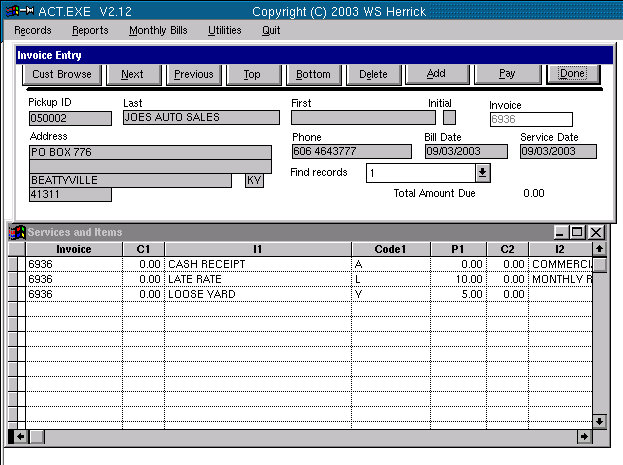

and you will see something like this:

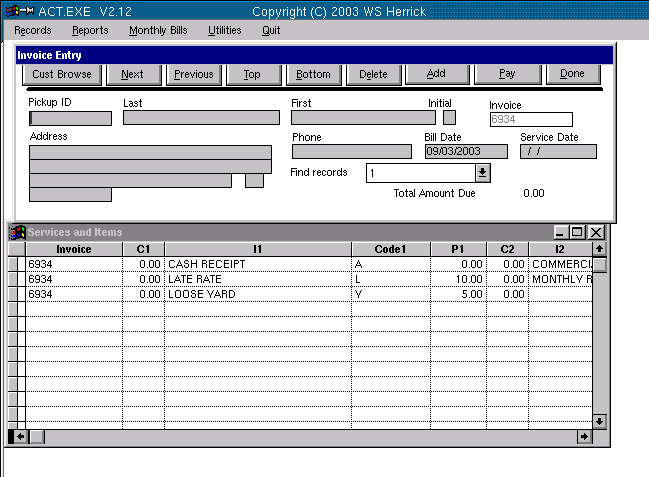

Please note the lower window. Scroll to the right until you can see

the C2, I2,Code2, P2 fields.

Also note: If you have arranged the window in the past the columns

may be narrower.

Key in a 1 in the field called C2, immediately to the left of the word COMMERCIAL

Key in the Dollar amount you wish to charge the customer in the P2 column.Check to be sure the decimal point is in

the right place.

Click on the DONE button. You have completed the entry of an invoice.

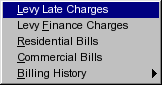

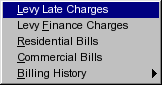

Running the Monthly Finance Charges for Commercial Customers

Please see the introduction to this section, How To Run Commercial

Bills, before proceeding.

Levy Finance Charges

Enter "C"

Printing the Monthly Bills for Commercial Customers

Enter the Statement Month and Year. Always enter 01 for the day

of the month.