HOWTO Use the Delinquent Program DLQ

DLQ integrates dozens of files and millions of datum to facilitate

putting delinquent debt onto Property tax bills. These bills then

become the basis under KRS 109 to aggressively pursue the outstanding

debt.

Each year delinquent debt accumulates for some customers.

Customers are dunned by written notice and newspaper ads. Some

65-90 days before the designated PVA Property Tax billing date (the day

the tax bills are due to be mailed), Notice of Intent (NOI) letters are

sent to the delinquent customers, and in the case that they are

renters, CC'd to the property owners. Only those who have been

notified 60 days in advance per KRS 109 can be attached to the PVA

bill.

This program permits the user to eyeball all the pertinant data, quicky

locate the correct PVA record, and compute the outstanding debt

(including recapture of past Amnesty credits). The debt is then

assigned to a PVA account and printed on the tax bill. As well,

the act must be preserved for audit, reporting and tracking. The

results of this program are used to drive the billing when the PVA

bills are run.

The Delinquent screen is very busy and crowded. Please follow this

tutorial carefully to learn to recognize the data presented and how to

properly sequence your lookup to best locate, calculate and assign the

outstanding debt. You will want a pencil and paper to jot down ID

#s, and perhaps a printout of the delinquent customers to annotate, as

you will discover bad data as you proceed, often in the imported data

sets that can only be repaired by other offices.

The rules for choosing debt and determining "good faith efforts to pay"

are complicated and set by management, but broadly: delinquent

debtors have met a threshold dollar debt, ignored billing and NOI's,

possibly reneged on their Amnesty contract if they have one, and may or

may not be making a good faith effort to pay. Further, there

must be a locatable property tax bill for the debt. All

these must be satisfied to properly attach a Solid Waste Debt to a PVA

bill.

It's important to note that the same debt will appear on the next Solid

Waste Bill run too. Paying the debt, however one is

notified,

settles all bills for that debt, so paying the Tax Billed Amount OR

the regular Solid Waste bill will satisfy the debt. Partial

payments

pay oldest debt first. Consider the case where a thousand

dollar debt

is placed on the Tax Bill, and the client is not paying their monthly

regular debt: if the client pays $1000, they have satisfied their

KRS

109 leinable debt, and are relieved of that legal redress. Had

they

paid less than $1000, they are still available to KRS 109

redress.

Locating renters, landowners and their mailing addresses is an ongoing

process. Additional tools and data sets are in the works to

better locate rentee/renters, and these can be applied throught the

calendar year. This document is limited to the 90 day

period before the PVA Mailing date.

Annual Maintenance

NB: all of the data presented by DLQ needs to be kept

current. Make a new working directory once each year after the PVA Mailing Date,

and set the desktop icons to reflect the new year. Near

year's end, each year, the FINAL copy of the PVA's "COMPLETE TRIM

O_TAX___.DAT" file, typically located in the "/TRIM/O/" directory, must

be copied to the working directory. This file will not be

available until the PVA has gotten state certfication, sometime after

August, usually. See the HOWTO

Act_Training_TRIM.html for more information. As well,

recent voter lists and phone books can be imported. One last essential component required

each year is the PVA's "TRIM bill print run spool file", made by the

TRIM program's bill run under Windows, typically something like: C:\WINNT\SYSTEM32\PRINTERS\SPOOL\00001.SPL

where the 00001 may be any #. Locate the spool file by time and

date-they should match the TRIM print run. You may have one more

layer of directories between PRINTERS and SPOOL, depending on your

installation. Copy the *.SPL file to the working directory.

First Time Setup: any new installation may require the browse windows

to be sized and placed.

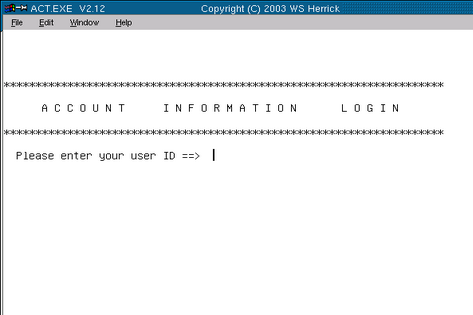

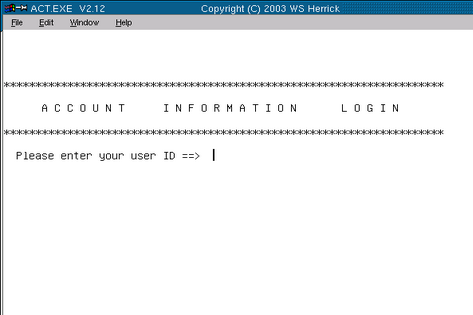

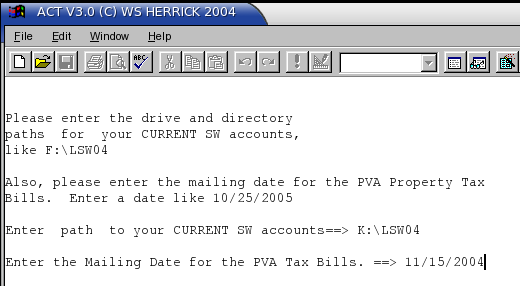

To Begin: LOGIN

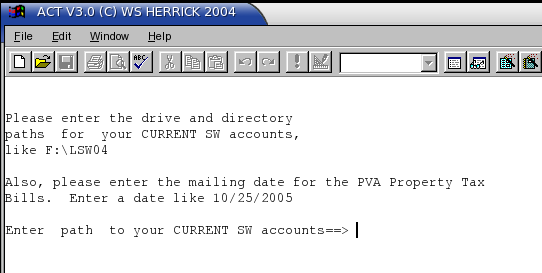

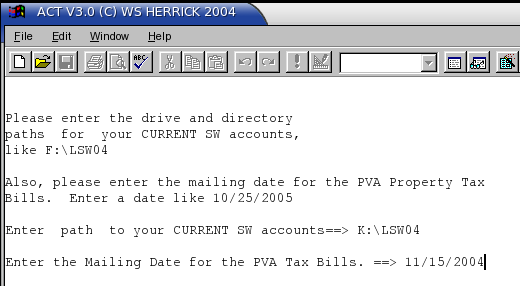

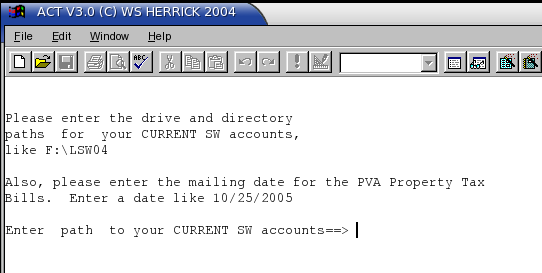

Locate Current SW Accounts

The DLQ program needs to locate your current (this year's) Solid Waste

Accounts, typically in a directory either named something like LSW05 or ACT_LEE. You can inspect the

properties of the icon you use to launch the ACT program to locate this

directory. Enter it in the form: F:\LSW04

PVA Mailing Date

Enter the planned PVA billing date-this is the date the PVA will

mail/postmark the bill, typically October 15. This date is Very Important to the debt logic.

60 days prior is the NOI cutoff-all NOI's must be mailed before

this date. It also defines the 90 days past due date. All

debts YOUNGER than 90 days are excluded from the debt put on the PVA

bill.

In the event that the PVA changes the mailing date, all the

calculations based on the original due date should be recomputed.

This means going back through ALL the Delinquent records, unless you

decide to not pursue the new debt that ages past 90 days (because of

the new PVA mailing date). If you forgo the recently aged debt,

no recalculations are required.

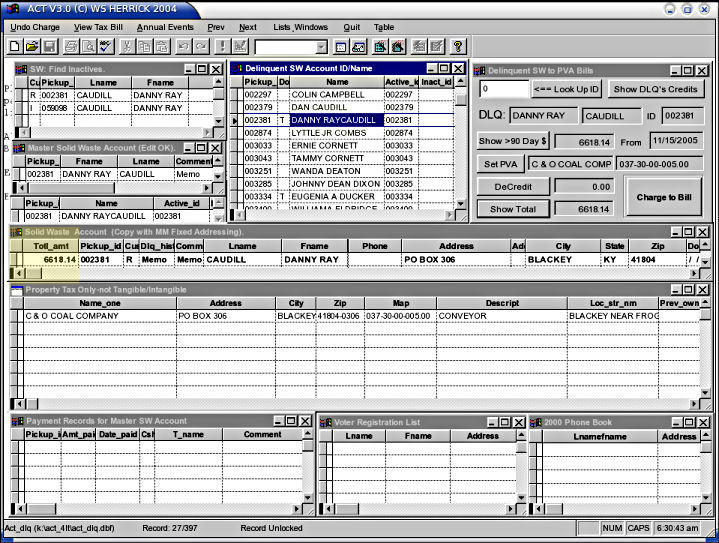

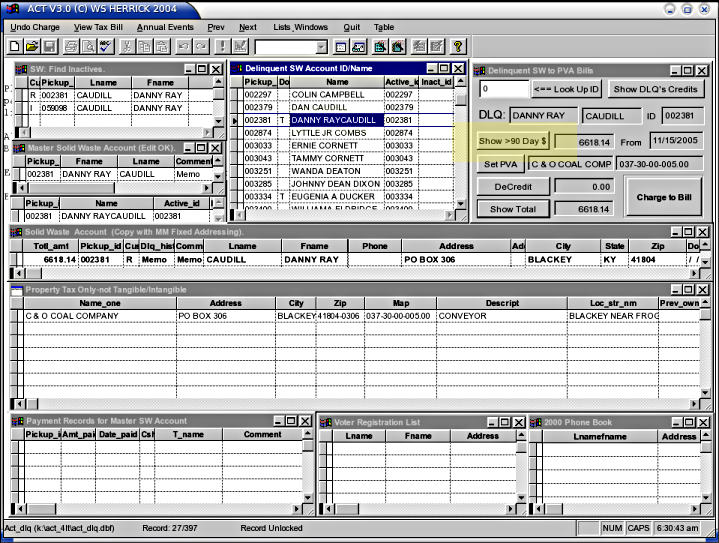

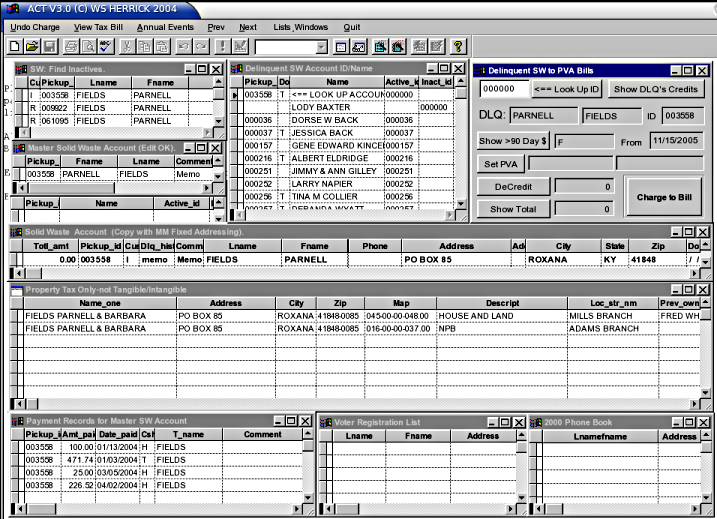

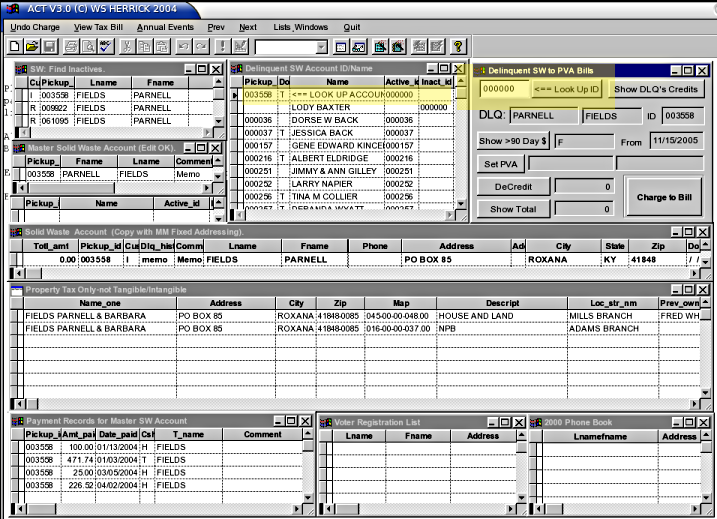

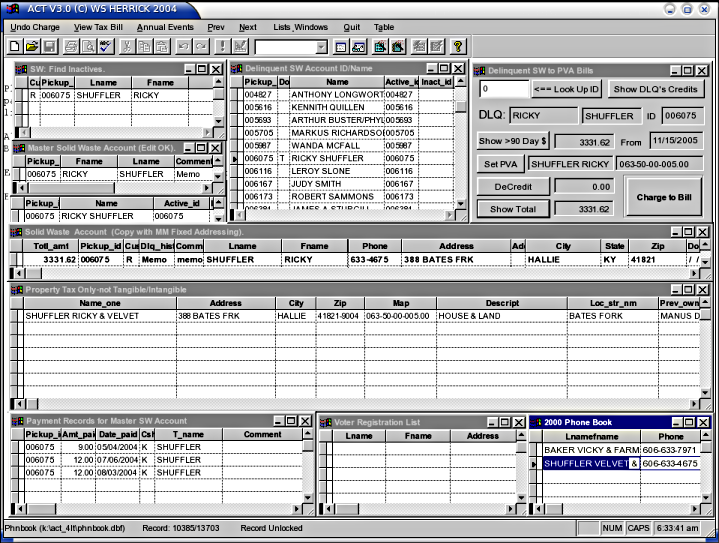

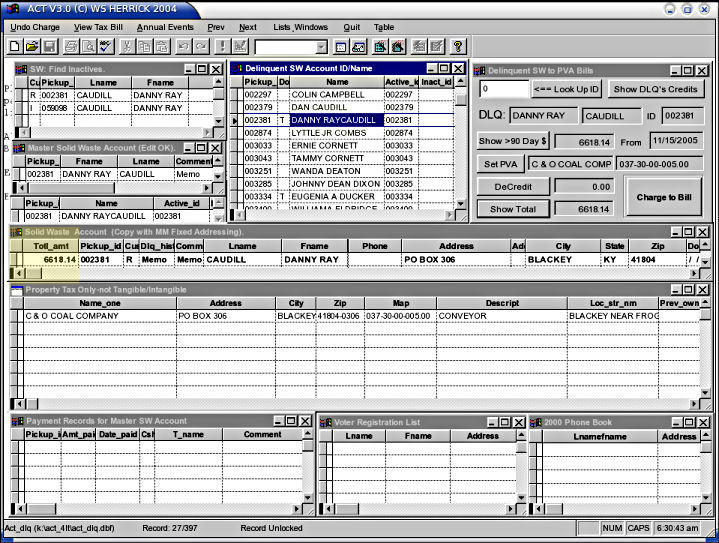

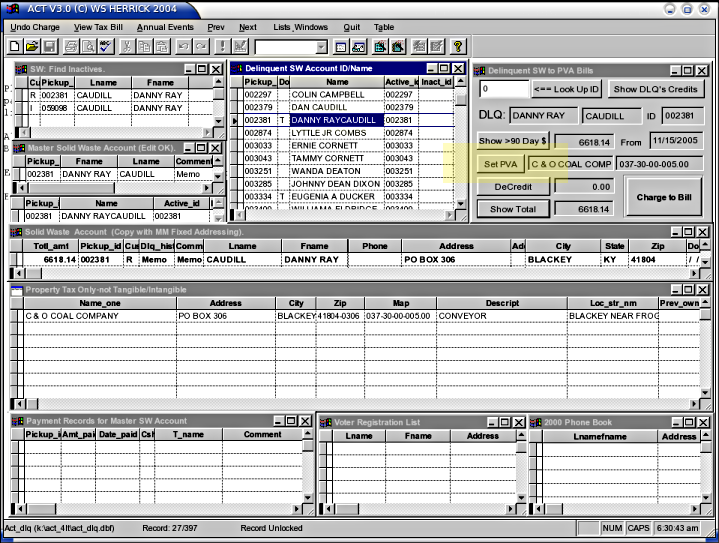

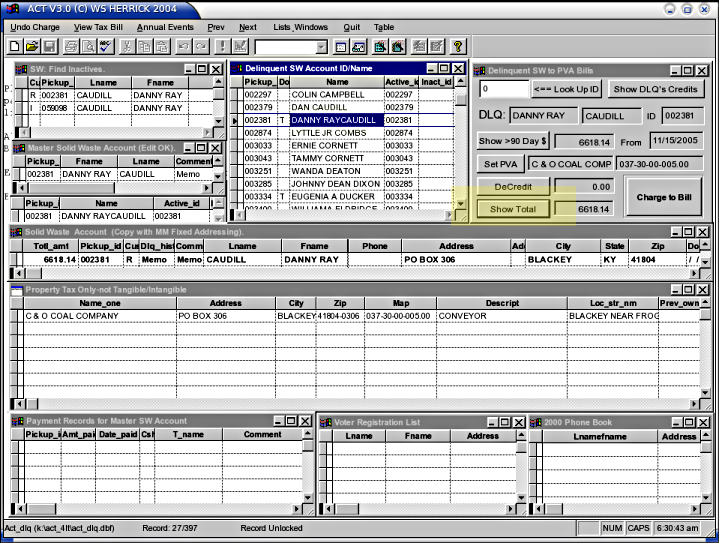

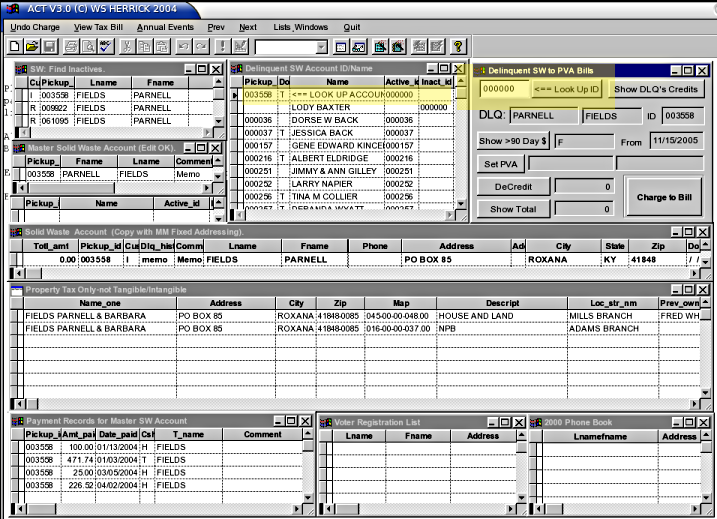

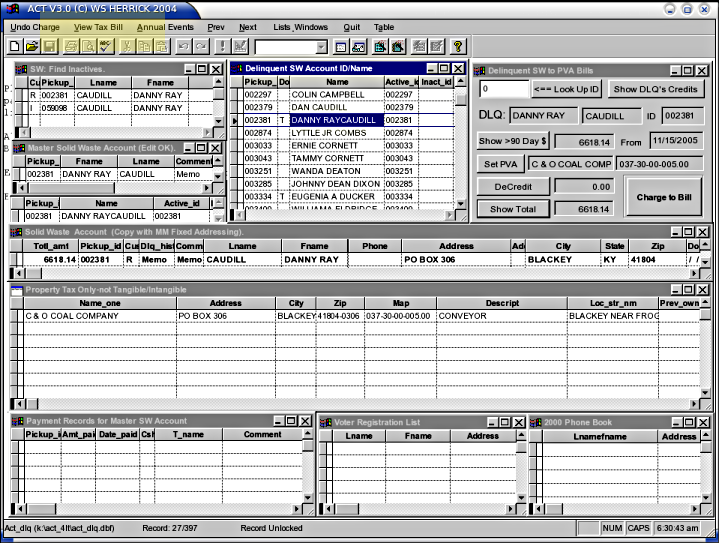

The Main Screen

A busy place. There are 9 "browse" windows visible, 2 not shown,

the form Delinquent SW to PVA Bills

near the top right corner, and a top menu bar.

The Browse Windows are all tied to the top center one, titled Delinquent SW Account ID/NAME, and

as you scroll through this list all others follow. The delinquent

accounts are presented in account order. This list is the

heart of the effort, and in it you reconcile all the debts, dates, and

accounts. Brevity and screen space hide a lot of that information

from you, but in fact all the "tagging", calculations and decisions are

recorded in the ACT_DLQ.DBF

presented in the Delinquent SW

Account ID/NAME window. This file drives the debt onto the

tax bill.

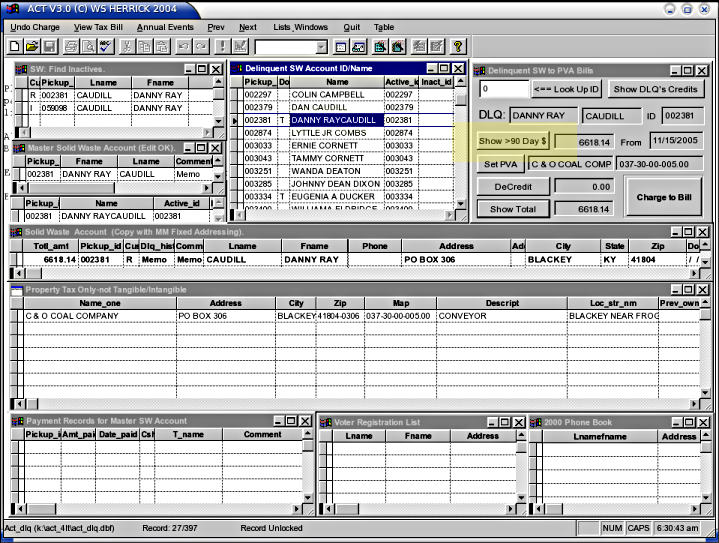

The most important field on the screen is in yellow, below.

This is the total current debt reported in the MM Corrected copy of the

Master Solid Waste

Customer file, ACT_CUST.DBF.

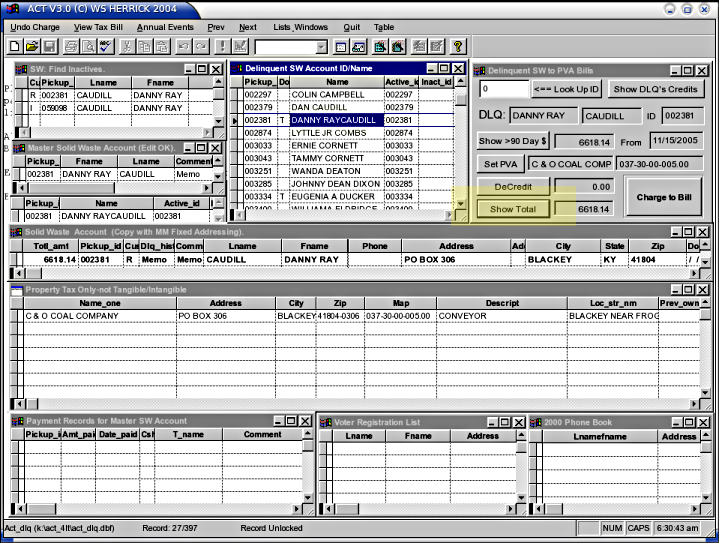

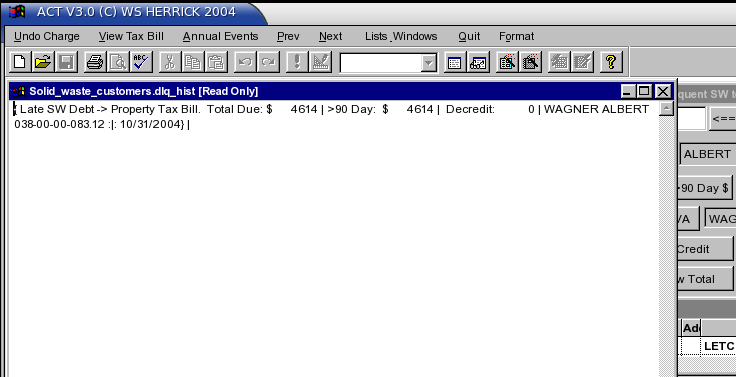

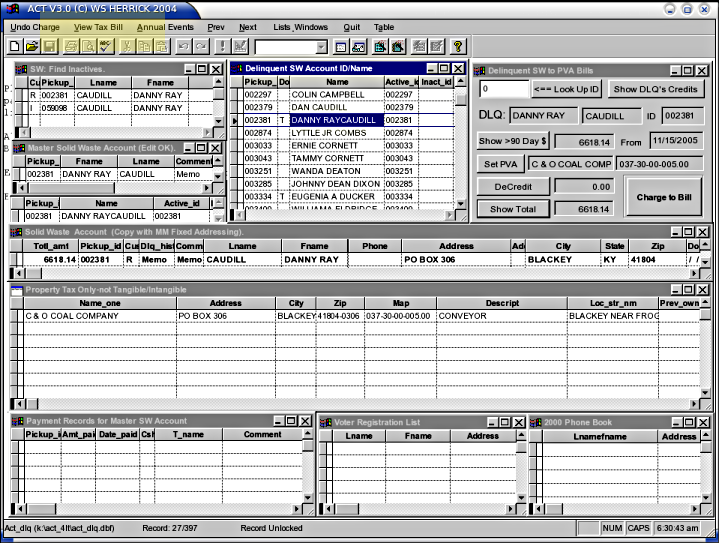

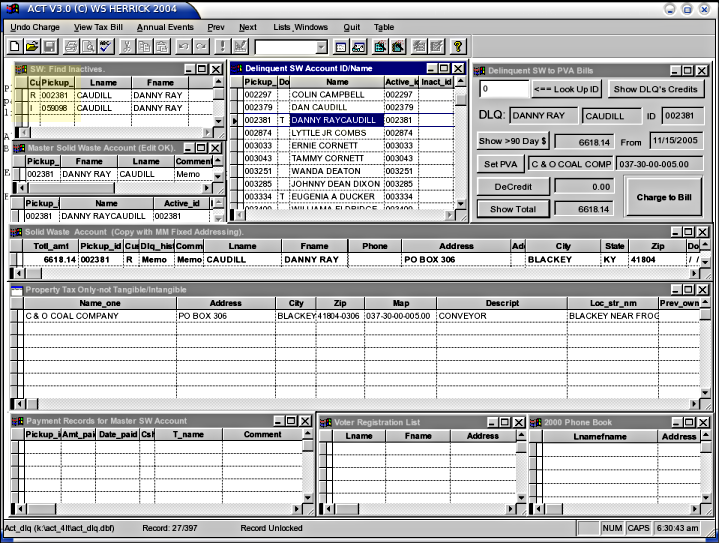

In the above screenshot, the Delinquent

SW Account ID/NAME list is highlighted in blue, and account

002381 has been tagged by clicking on the name DANNY RAY CAUDILL.

Note that this record shows a commercial property and a residential

pickup with a common mailing address.

The form (top right) is detailed below. It is introduced first to

lay out the basic process. The windows will be decribed next.

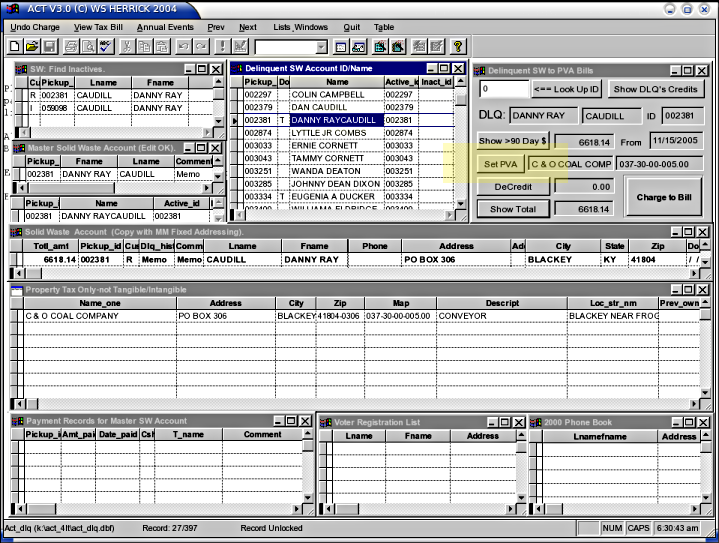

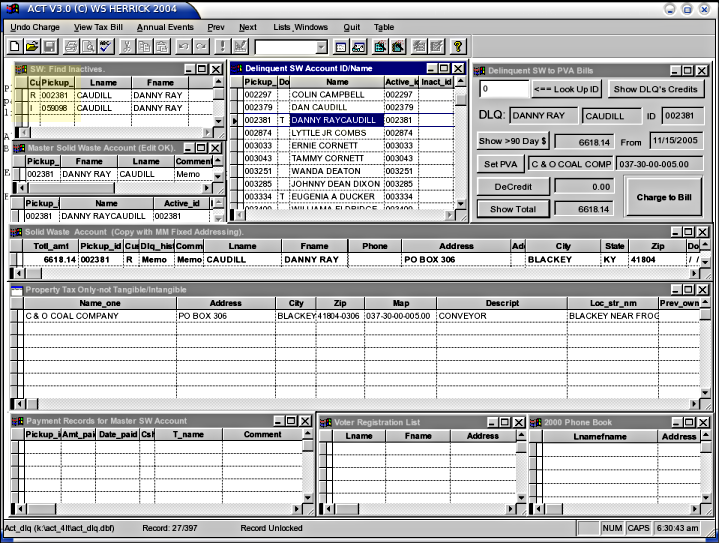

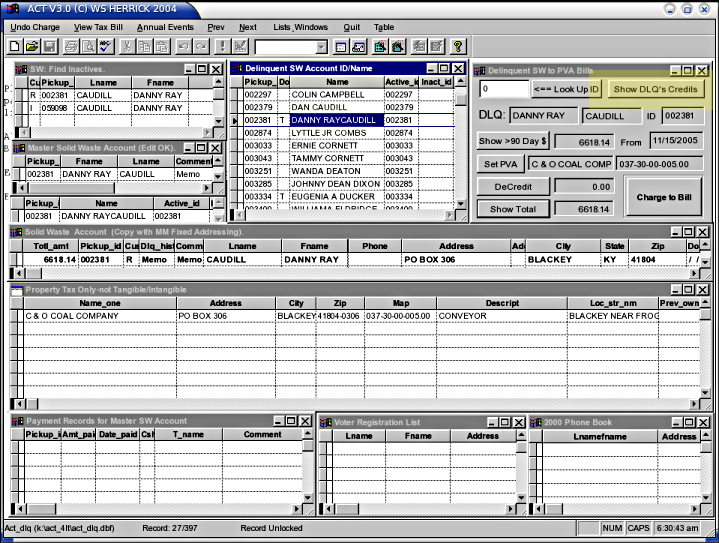

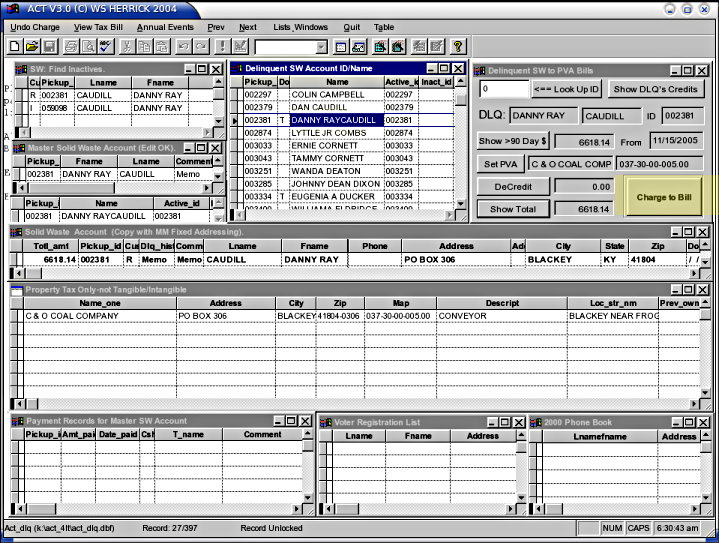

The Delinquent SW to PVA Bill Form

Is also busy, with 7 buttons and 10 data fields. The form's

buttons

lay out the sequence used to process the current delinquent

account.

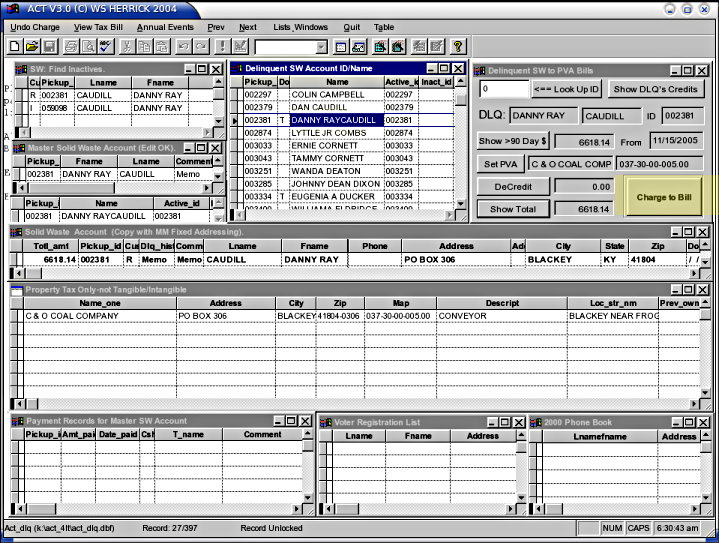

The form and it's fields need manual refreshing: data is not

updated

until you click on a button. Most fields need their adjacent

button

pushed to show and/or set the field value. Push them in the

sequence

you discover and tag data in the browse windows. By tagging, I

mean to

mouse click on the precise record line in the list. When tagged, a

small black triangle should appear at the left of the record row.

It's

best to tag the source record then promptly click the

button. More

than 5 seconds is too long, as the windows will refresh their data

connnections, and your tag may slip. Again, make a practice of

clicking & tagging the window record, then click the form button.

The Form Buttons are listed below, in the basic sequence you'll use

them.

Show >90 Day $

Once you've scrolled to the delinquent record you want to check out,

click this button. it does the math on debt aging and puts

the result

in the field to the right of the button.

Set PVA

Look at the Property Tax window & find the best of the good records

and tag it. Now click the Set PVA button to tie the debt to this

PVA

account. Several PVA fields are then copied to the ACT_DLQ.DBF record, like the map

number, name, account and description.

Show DLQ's Credits

This assembles and sorts ancestral ACT_PAY.DBF

credit (T type) records by dollar amount. Amnesty credits for the

current account are presented in dollar order. If present, tag

the

amnesty credit and close the browse window.

DeCredit

Inspect this years payments and determine if the client's good faith

efforts earn a defferal of the amnesty recapture.

If they get warrent

good faith, do not click DeCredit. If they have an Amnesty Credit

tagged and do not warrent relief, click DeCredit, and the amount

credited will be attached to the total debt.

Show Total

Click this anytime to run the calculations and present a grand total

debt. Click this before Charge to Bill.

Charge to Bill

This is the commit step that writes the displayed values to the data

files. You can use the menu UnCharge button to clear a mistaken

charge. Tag the Delinquent record first, then click UnCharge.

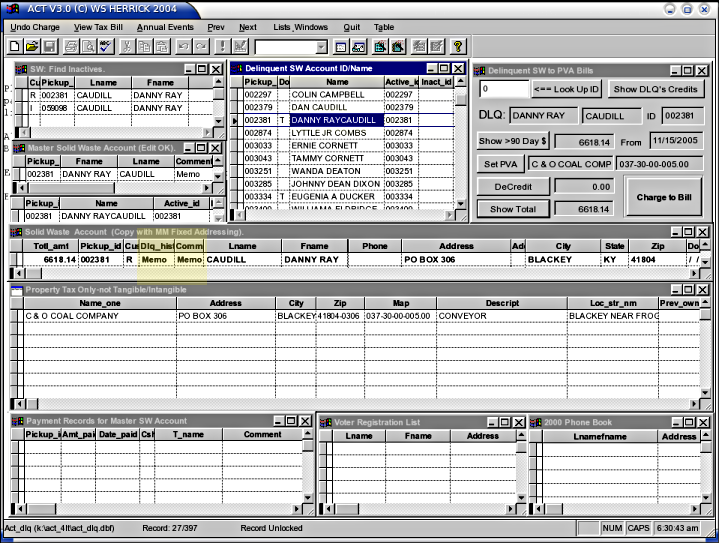

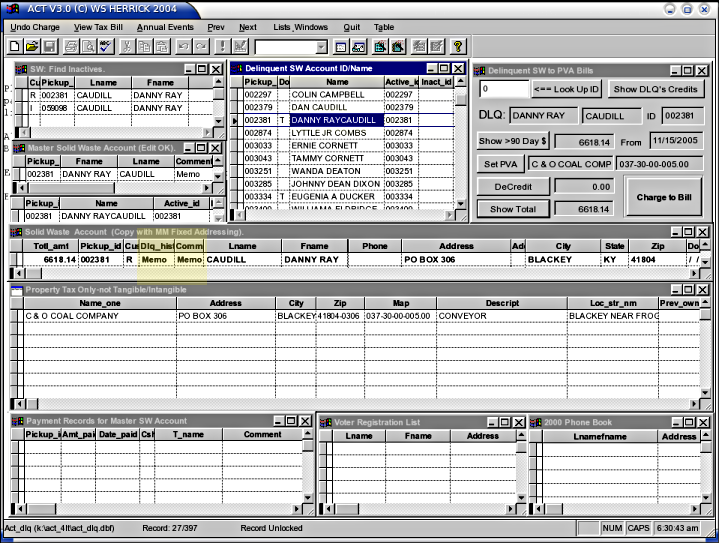

Once you have charged an account, the m

becomes M in the Dlq_hist field of the Solid Waste

Account.

If you click on the word Memo, you will see the delinquency history for

the account you just processed.

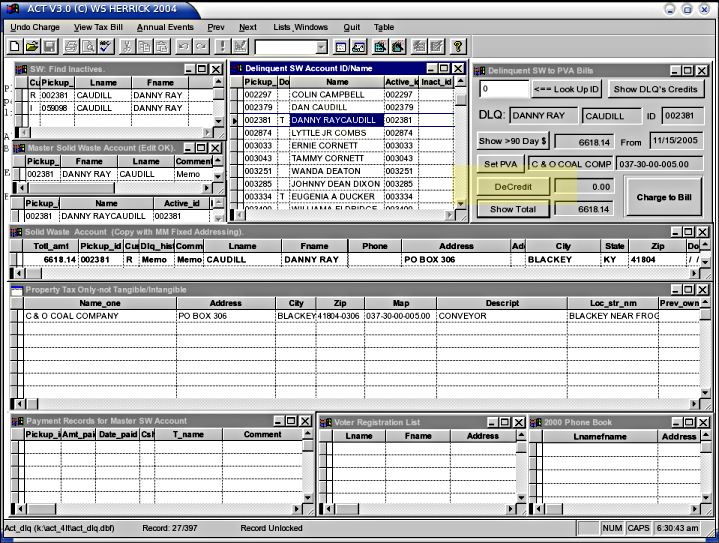

Look up ID

The Lookup is informational, and this is NOT the

place to set debts or tag a PVA Bill. Use the look up to check

out related accounts for PVA records, Amnesty Credits, etc, but be sure

to return to your original Delinquent SW Account record in the top

middle window before you use the form or menu to alter data.

Enter an account number in the field to the left of the Look Up ID

button, then press the button. All the related records for the

account you entered will be displayed.

If a delinquent account has the wrong account number, edit the value in

the Pickup_ID field to correct it: click back in the Delinquent SW Account ID/NAME list

window, and there find the offending client, edit the Pickup_ID field

for that client in the Delinquent SW

Account ID/NAME list, and fix the ID #.

DO

NOT use the Delinquent

SW to PVA Bills form

or it's buttons to tag things when you are just Looking Up IDs.

Only

use the form's buttons when you have the right Delinquent customer

showing in the Delinquent SW Account ID/NAME list.

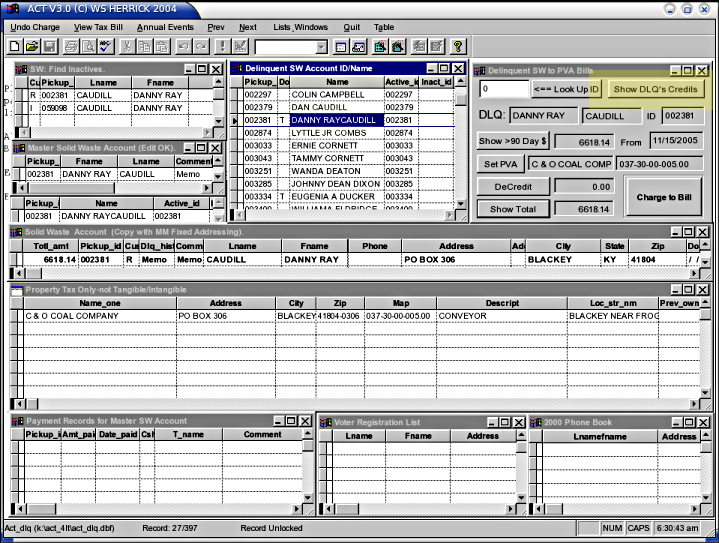

The other windows are:

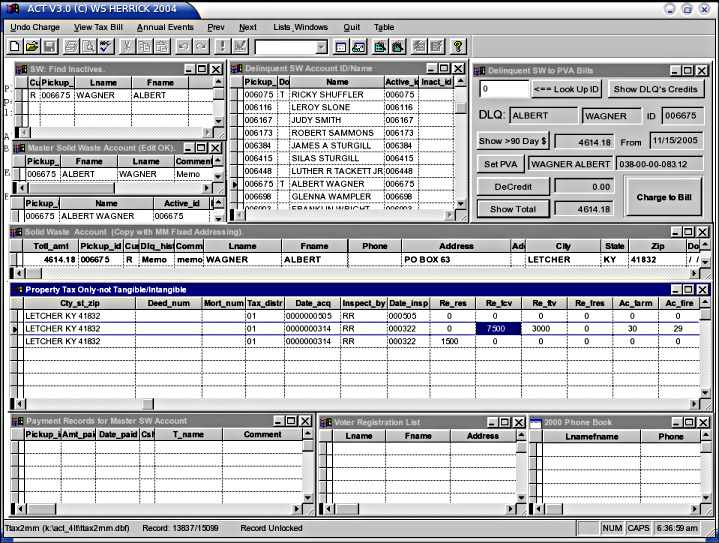

SW: Find Inactives

Shows SW accounts by both names (last+first). Look here to see

the Inactive/Active status and account #'s. If you see a second

account you can use the Look Up ID button on the form to check out the

account # to see if it has an outstanding balance, an amnesty

credit, or any Comments. This is detailed below.

Please Note: This Lookup is informational, and this is NOT the

place to set debts or tag a PVA Bill. In the event that

the Delinquent SW Account

ID/NAME list ID number is wrong, or points to the Inactive

account, click back in the Delinquent

SW Account ID/NAME list window, and there find the offending

client, EDIT THE RECORD FOR THAT CLIENT in the Delinquent SW Account ID/NAME list,

and fix the ID #.

DO

NOT use the Delinquent

SW to PVA Bills form or it's buttons to tag things when you are

just Looking Up IDs. Only use the form's buttons when you have

the right Delinquent customer showing in the Delinquent SW Account ID/NAME list.

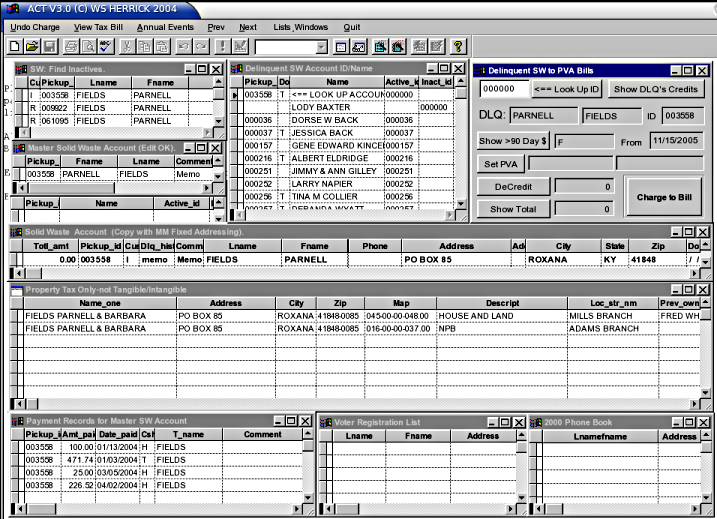

Master Solid Waste Account

Shows the current Solid Waste record for the ID# of the current Delinquent SW Account ID/NAME

record. The Comment field may have useful information.

Click 2x on it to read the comments.

NOI'd

Shows the Name and Account # that received a Notice of Violation.

This is just for confirmation, but should you fail to see the same

value as in the Delinquent SW Account

ID/NAME list, there is an error and you need to investigate it

before tagging any debts.

Solid Waste Account (Copy with MM Fixed Addressing)

Shows a recent copy of the Master Solid Waste accounts with Mail Man

corrected addresses-these match better in street name comparisons and

are used to locate PVA records by address.

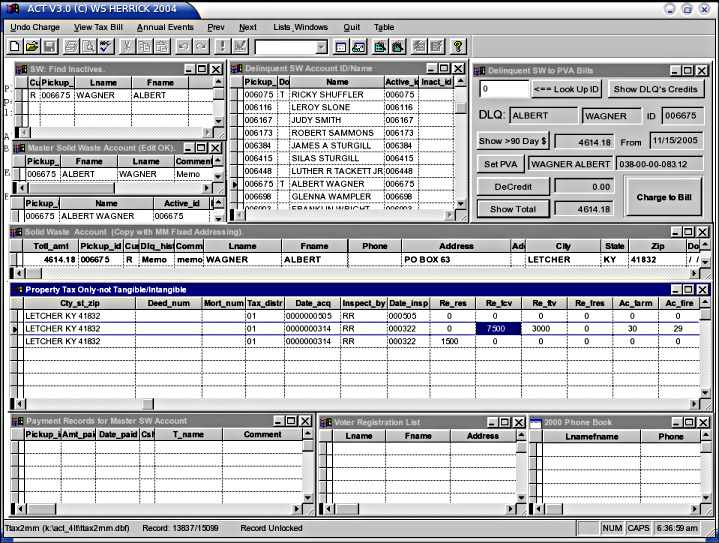

Property Tax Only -Not Tangible/Intangible

Shows the current Complete TRIM record from the PVA's O_TAX___.DAT

file. This is a copy of the PVA's account, and much data is made

visible by moving the window's bottom slider to the right. The

valuations are about 1/4 of the way across the record, choose the

largest if you are presented with a choice of PVA records to tag.

Only the four columns that start with Re_

have values of consquence here.

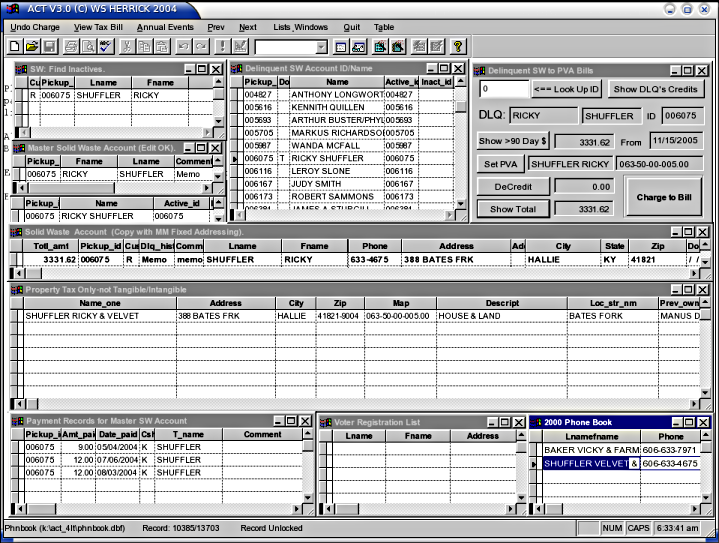

Payment Records for Master SW Account

Show this year's payment records to determine the "good faith effort to

pay".

Voter Registration List

Records listed here share the same mailing address as the Property Tax

record-you may find the SW debtor's name here, corroborating the link

to the SW account.

2000 Phone Book

Like the Voter list, records here add individual names to

corroborate the link from the SW account to the PVA account.

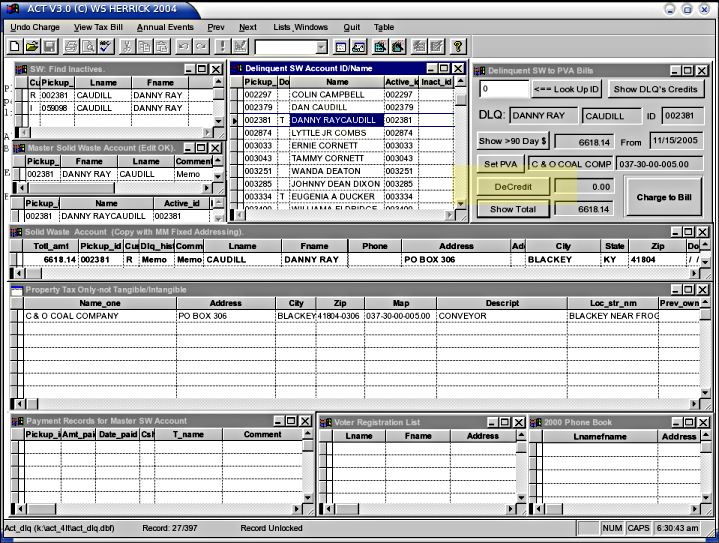

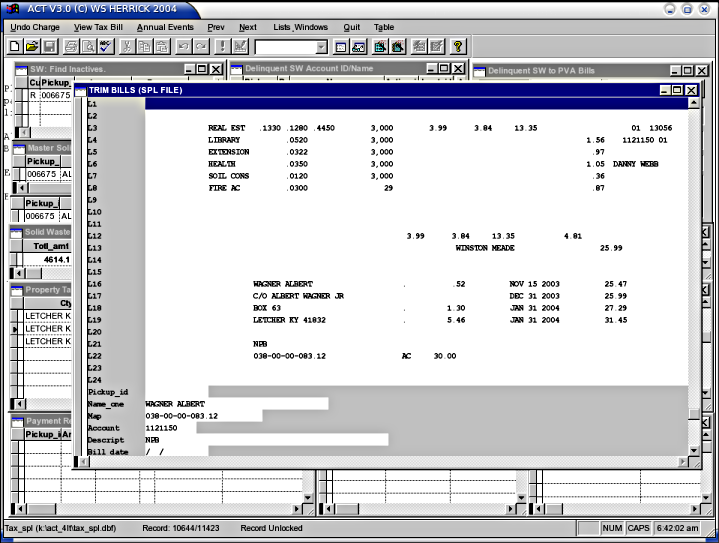

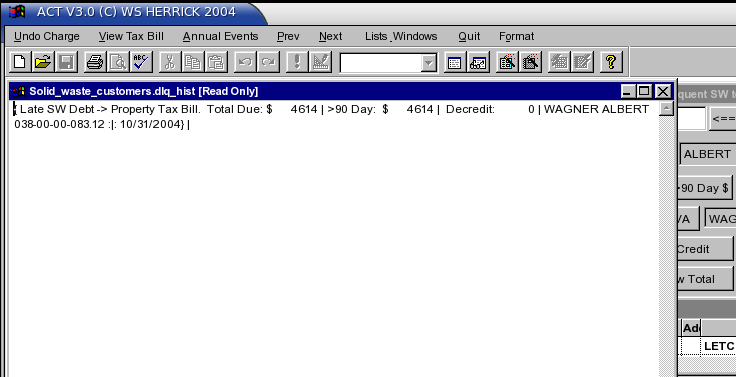

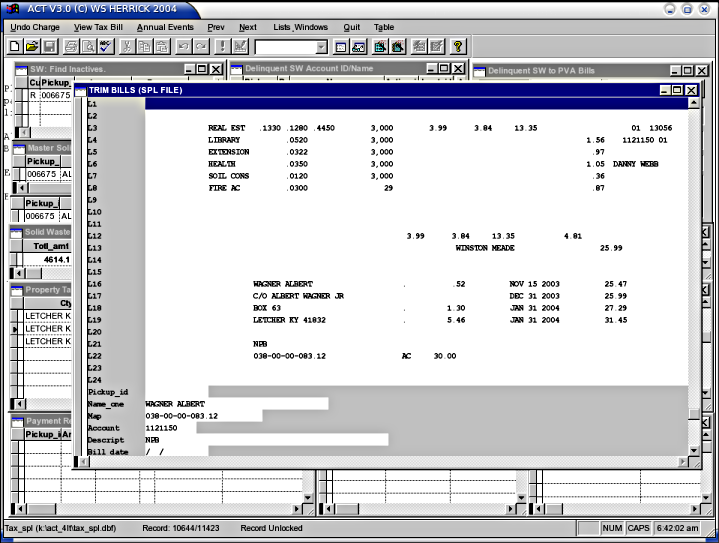

The Two Windows Not Shown

Show the results of the AmnestyCredit record search, and the PVA

Tax bill as printed to the TRIM spool file. The first window

comes up when you click on the Show

DLQ Credits button and covers the Delinquent SW to PVA Bills

form. While open, it shows all credits since 1997 (or your start

of ACT record keeping) sorted by amount. If the SW customer has

ever received a credit to the account ID shown in the Delinquent SW Account ID/NAME list,

that credit will be listed. Amnesty credits tend to be large and

will sort to the top. Verify the Amnesty credit once you've

located a likely credit record by checking the Amnesty Receipt paper

file. Once you'e made the determination on the amnesty

credit, highlight the correct record in the credit record &

close the window to reveal the data form. Click on the

DeCredit button to charge the amnesty credit to the Delinquent

account.

At Press Time, no entry is made in the Master SW accounts to reflect

this charge-you must make an invoice to each account you DeCredit.

The Menu

You can use the menu UnCharge button to clear a mistaken

charge. Tag the Delinquent record first, then click UnCharge.

Use the View Tax Bill button to show any matching tax bill from the

TRIM print run spool file. Not all PVA accounts are billed, so

you may meet the occaision where no bill is being generated.

Annual Events is largely described in another document,

Act_Train_TRIM.html.

Prev/Next move you up or down in a list.

List & Windows offers a menu line for each window so you can

re-open one in case you close it.

Quit quits.